New Approach to Trade in Nifty Option

Often traders misunderstand the nifty option trading. The reason is quite simple because quite few traders used to investigate the internals of an option. I am sure if you will read this article till the end then you will discover many interesting facts about trading in nifty options.

Why nifty options? Why not for script options? At this time just accept this article only to trade in nifty options. I will answer this question at the end of this article.

Nifty options are of plane vanilla options and by nature they are European. Option of Nifty is available in different strikes with a 50 point difference between them. Options are often traded in premium which is a derivative of their underlying asset. This premium is different for different strike options. The mathematical input required to calculate the option premium is

The mathematical formula used for calculating the option price called black and shoals formula. This is base formula for option price calculation. However many variation of this formula is being used to calculate the option premium. Like for dividend paying stock it is different, for European options it is different, for American options it is different.

Your common experience must say you that the stock or index price is sensitive to the news, rumors, domestic and international events….etc. Since option is a derivative of the underlying asset it also is sensitive to these events but these events we never used to track for the options. The sensitive events which we track for the options are represented in Greeks. As an option trader though these Greeks are important for you but in the context of this article I find this is not necessary for you to learn the Greeks ,Because I am going to give you a wonderful tool to use.

You must be wondering that with so much of inputs and lot of calculation at end what we are going to achieve- Just the price of the option. If it is so then I will say "No". The real benefit you have not yet experienced. Let me explain few benefits.

Just think it will be wonderful if you will know the maximum loss you can incur in a trade strategy within a short period of time same way the profit you can make in that same time frame if your assumption goes right.

What is the real benefit of trading in Nifty option for intraday? Say Nifty is at 5100 and nifty 5100 call option is at Rs100. If I will buy one lot of nifty future with lot size as 50 then my trade value is 5100*50=255000/-. Same time to take this position I need margin money of Rs25500/- at 10% rate just to open this position. However as an option buyer I need only Rs100 X50=Rs5000/- to open a position. In option intraday trading the fund requirement is less as compared to the future trading. The major problem is to calculate the realistic stop loss and target for the option premium. But this problem has a pretty good solution.

Then you must know the best tool which you can use for doing this calculation. The only answer is the binomial option price model.

What is the binomial option price model? In binomial option price model the 2 possibility of the underlying price is being derived and the option price at each node is being derived with constant volatility and variable volatility condition.

Let us see one example say Nifty future is at 5100 and days low is 5025 and high is 5150. Assume I have made two random choices say nifty may go to 5125 or fall to 5075 within hour. It just a random choice and it is my assumption. No technical is associated with it. At this point if I will ask you to find the price of nifty 5100 ce at these 2 price point hope it will be in a position to find it out using any option calculator. Now the key question is volatility.

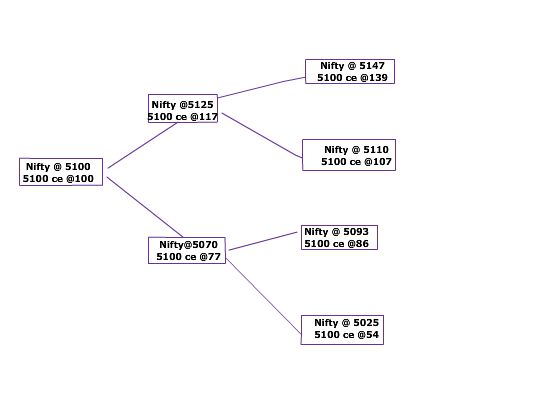

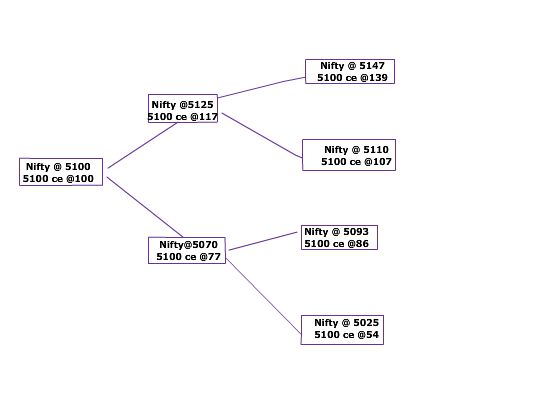

How to find this volatility? It is not possible to calculate the option volatility by doing the backward computation. The only way left out is to use the numerical analysis procedure called Newton raptions method or bisection method to do this job. Below graph explains the binomial tree for option.

So till this point you have understood the following

Using this concept you can also evaluate the performance of various option strategies with 5 to 10 days time decay at different price target points. You must be feeling so much of work only one mathematician can do or any software can solve this. You are absolutely right. To make you more confident and to use this entire concept practically I have designed this binomial option calculator and the web version is freely available in my web site. Just register yourself in the site and start using it. I have used the Gann angle method to calculate various price points projected from the current price. At those price points I have forecasted the price of a particulate strike option. I have also used the Newton raptions method to calculate the actual volatility associated with the option premium. By decreasing the days till expiry you can forecast the future price of the option premium in more realistic manner.

This tool can be used as the best tool for making an intraday option trade decision. However out of many benefits this too have few limitations. If you have less then 5 days till expiry then this tool will not forecast properly. If you want to find the premium of deep out of money options like 25 % up or down from the current level then this tool will not work properly. At the beginning I have told you to trade only in nifty options. Though my tool is useful for stock options, but the trading in Nifty options for intraday gain has many benefits. Like index is independent from the sector. It is often easy to understand and technically calculate the targets for the index. In index options the volatility never changes dramatically in intraday. The last major benefit is liquidity. Hence I have advised to trade in Nifty options for intraday gain.

This basic understanding of the options and use of my online tool will make you a successful option trader.

Why nifty options? Why not for script options? At this time just accept this article only to trade in nifty options. I will answer this question at the end of this article.

Nifty options are of plane vanilla options and by nature they are European. Option of Nifty is available in different strikes with a 50 point difference between them. Options are often traded in premium which is a derivative of their underlying asset. This premium is different for different strike options. The mathematical input required to calculate the option premium is

- volatility

- Interest rate

- Strike price

- Nature of option (i.e. call or put)

- Type of option (American or European)

- Current price of Underlying asset

- Life span of the option or days remaining for the option to expire

The mathematical formula used for calculating the option price called black and shoals formula. This is base formula for option price calculation. However many variation of this formula is being used to calculate the option premium. Like for dividend paying stock it is different, for European options it is different, for American options it is different.

Your common experience must say you that the stock or index price is sensitive to the news, rumors, domestic and international events….etc. Since option is a derivative of the underlying asset it also is sensitive to these events but these events we never used to track for the options. The sensitive events which we track for the options are represented in Greeks. As an option trader though these Greeks are important for you but in the context of this article I find this is not necessary for you to learn the Greeks ,Because I am going to give you a wonderful tool to use.

You must be wondering that with so much of inputs and lot of calculation at end what we are going to achieve- Just the price of the option. If it is so then I will say "No". The real benefit you have not yet experienced. Let me explain few benefits.

- On 27th November 2009 I have told the traders to buy 5000 call option of Nifty at 105 when nifty was at 4870 with stop loss 67 at 4775 level for target 137 at 4950 level.

- On 27th November I have told the traders to buy nifty 5100 call option at 91 five lots and sell 5000 call option 2 lots at 133. The maximum loss is Rs7000 if nifty fall to 4700 within 5 days and profit Rs7000 if nifty climb to 5100 within 5 days.

Just think it will be wonderful if you will know the maximum loss you can incur in a trade strategy within a short period of time same way the profit you can make in that same time frame if your assumption goes right.

What is the real benefit of trading in Nifty option for intraday? Say Nifty is at 5100 and nifty 5100 call option is at Rs100. If I will buy one lot of nifty future with lot size as 50 then my trade value is 5100*50=255000/-. Same time to take this position I need margin money of Rs25500/- at 10% rate just to open this position. However as an option buyer I need only Rs100 X50=Rs5000/- to open a position. In option intraday trading the fund requirement is less as compared to the future trading. The major problem is to calculate the realistic stop loss and target for the option premium. But this problem has a pretty good solution.

Then you must know the best tool which you can use for doing this calculation. The only answer is the binomial option price model.

What is the binomial option price model? In binomial option price model the 2 possibility of the underlying price is being derived and the option price at each node is being derived with constant volatility and variable volatility condition.

Let us see one example say Nifty future is at 5100 and days low is 5025 and high is 5150. Assume I have made two random choices say nifty may go to 5125 or fall to 5075 within hour. It just a random choice and it is my assumption. No technical is associated with it. At this point if I will ask you to find the price of nifty 5100 ce at these 2 price point hope it will be in a position to find it out using any option calculator. Now the key question is volatility.

How to find this volatility? It is not possible to calculate the option volatility by doing the backward computation. The only way left out is to use the numerical analysis procedure called Newton raptions method or bisection method to do this job. Below graph explains the binomial tree for option.

So till this point you have understood the following

- To forecast the option price you need to use the binomial option calculator

- You need to use the Newton raptions method to calculate the volatility.

- In order to calculate the target and stop loss points of nifty to use it in various binary nodes I will use the Gann method. So these 3 steps will make me to forecast the option price like a wizard.

Using this concept you can also evaluate the performance of various option strategies with 5 to 10 days time decay at different price target points. You must be feeling so much of work only one mathematician can do or any software can solve this. You are absolutely right. To make you more confident and to use this entire concept practically I have designed this binomial option calculator and the web version is freely available in my web site. Just register yourself in the site and start using it. I have used the Gann angle method to calculate various price points projected from the current price. At those price points I have forecasted the price of a particulate strike option. I have also used the Newton raptions method to calculate the actual volatility associated with the option premium. By decreasing the days till expiry you can forecast the future price of the option premium in more realistic manner.

This tool can be used as the best tool for making an intraday option trade decision. However out of many benefits this too have few limitations. If you have less then 5 days till expiry then this tool will not forecast properly. If you want to find the premium of deep out of money options like 25 % up or down from the current level then this tool will not work properly. At the beginning I have told you to trade only in nifty options. Though my tool is useful for stock options, but the trading in Nifty options for intraday gain has many benefits. Like index is independent from the sector. It is often easy to understand and technically calculate the targets for the index. In index options the volatility never changes dramatically in intraday. The last major benefit is liquidity. Hence I have advised to trade in Nifty options for intraday gain.

This basic understanding of the options and use of my online tool will make you a successful option trader.